Falling Mortgage Rates Are Bringing Buyers Back

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.

After months of high rates keeping buyers on the sidelines, things are starting to shift. Rates are already coming down due to a number of economic factors. And yesterday the Federal Reserve cut the Federal Funds Rate for the first time since they began raising that rate in March 2022. And while they don’t control mortgage rates, this sets the stage for mortgage rates to fall even further than they already have – especially since more cuts from the Fed are expected into next year. And lower mortgage rates are bringing more buyers back into the market. Lisa Sturtevant, Chief Economist at Bright MLS , says:

“A drop in the cost of borrowing will help fuel more homebuyer demand . . . Falling rates will also bring more sellers into the market.”

The best part? You can take advantage of that renewed buyer interest.

As Rates Fall, Buyer Activity Goes Up

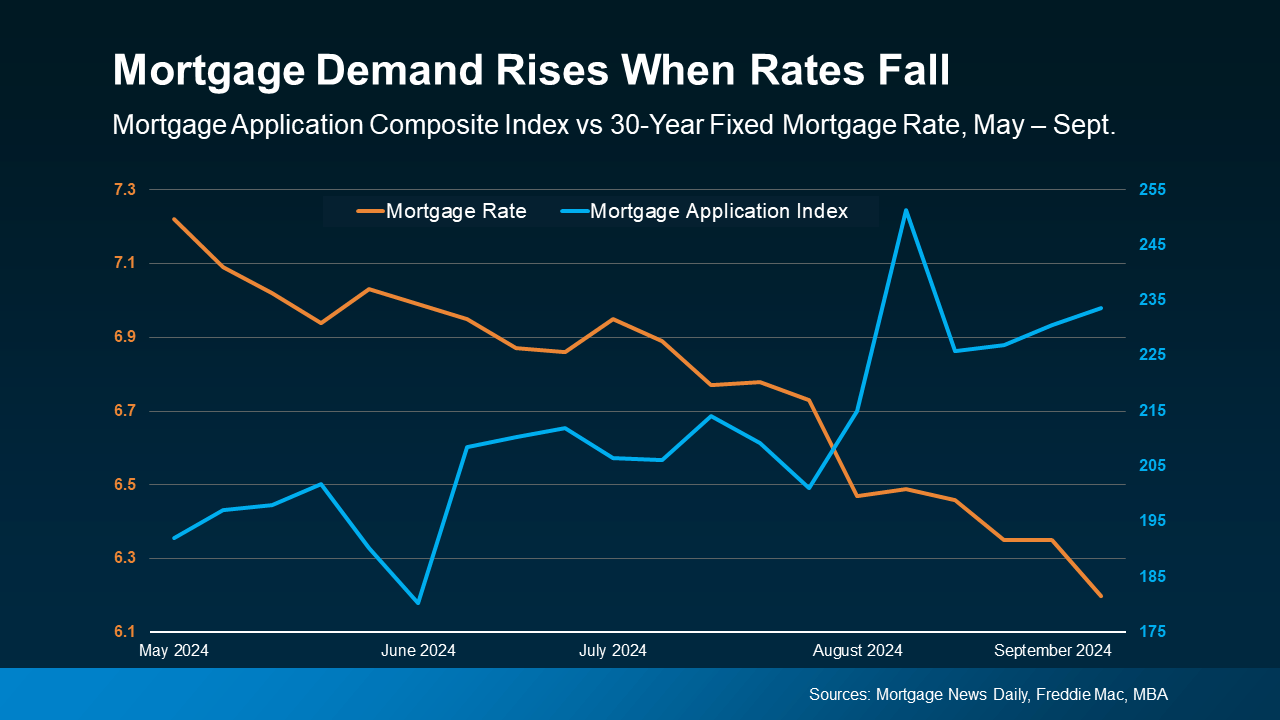

The graph below illustrates the relationship between falling mortgage rates and rising buyer activity. The orange line represents the average 30-year fixed mortgage rate, while the blue line shows the Mortgage Bankers Association (MBA) Mortgage Application Index , which tracks the number of mortgage applications.

As you can see, as mortgage rates ( orange ) come down, the Mortgage Application Index ( blue ) rises, showing more people start to re-engage in the process ( see graph below ):

What This Means for You

What This Means for You

According to the National Association of Realtors (NAR), home sales increased in July, which was a welcome shift after four straight months of declines. If you're a homeowner thinking about selling, this uptick in buyer activity works in your favor.

More buyers means more competition, which can lead to higher offers and shorter time on the market for your house. And, according to Edward Seiler, AVP of Housing Economics at the Mortgage Bankers Association (MBA), this trend is expected to continue:

“MBA is expecting that slower home-price appreciation, coupled with lower rates, will ease affordability constraints and lead to increased activity in the housing market .”

All in all, the market is becoming more accessible to a wider range of buyers, which could result in even more people looking to purchase a house like yours.

With more buyers entering the market, now’s the time to start getting your house ready to sell.

Bottom Line

The recent decline in mortgage rates is already driving more buyers into the market, and experts project this trend will continue. Work with a local real estate agent to take advantage of this increased buyer demand and get your house ready to sell.